How to get a Hawaii Real Estate License

A number of requirements are required to be licensed in Hawaii as a realty agent. These include being at the least 18-years old, possessing a high school diploma/GED certificate, and having legal residency in the United States. You should also be known for honesty, integrity, financial integrity, fair dealing and truthfulness.

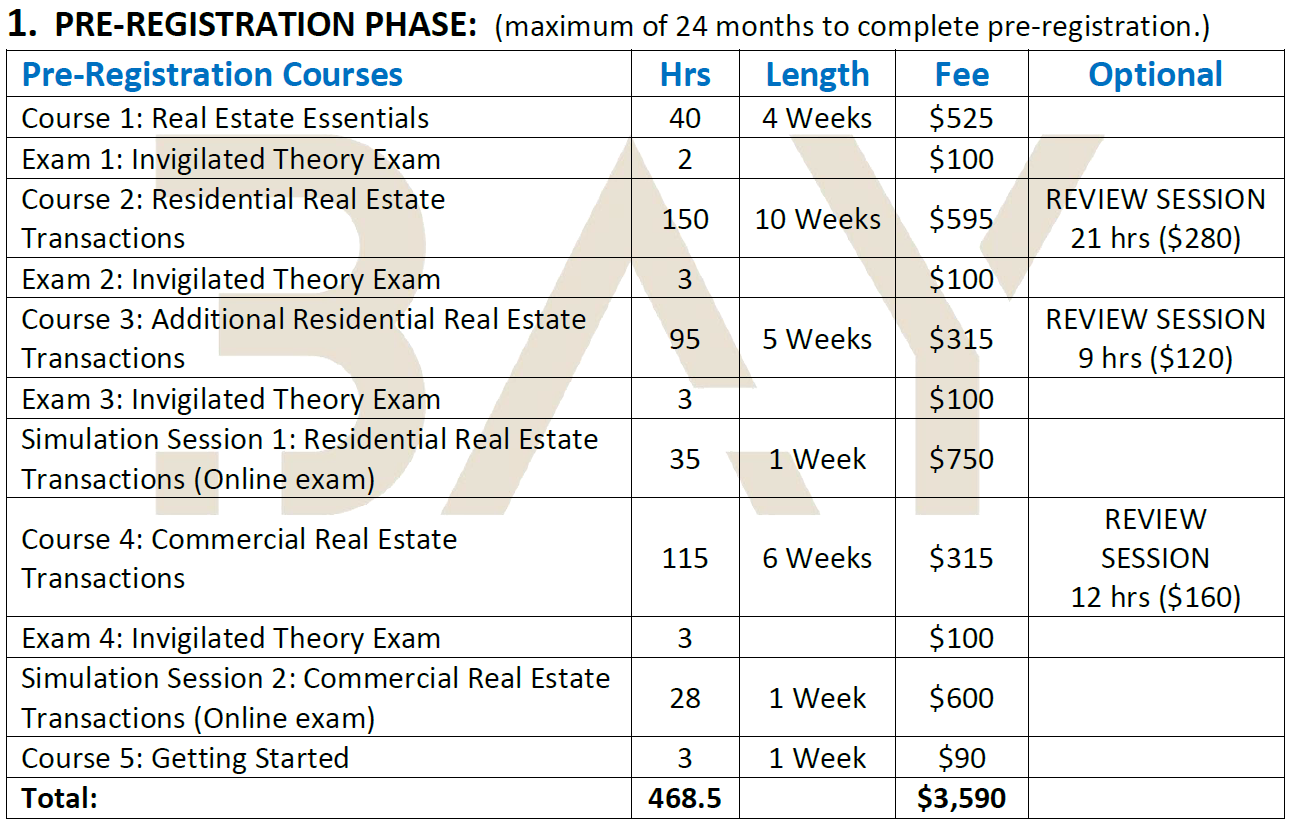

To obtain your real estate license in Hawaii, the first step is to take the pre-license educational course. This 60-hour program covers everything you need to know to become a licensed realty agent in hawaii. The course can take anywhere from a few days to a couple of months. So it is important you plan ahead to start the program as soon possible.

This course can be taken online. However, it is best to take it in person in order to get the right training and support you need in your industry. If you would like to attend this course in-person, you should sign up with a reputable school for real estate.

How to Get a Real Estate License in hawaii

You must pass both the broker and salesperson exams to obtain your real estate license in Hawaii. These exams are administered by the Hawaii Department of Commerce and Consumer Affairs Real Estate Division and are only open to residents of the state.

The exam consists two parts. These sections are designed to test both your knowledge and understanding of general principles in real estate as well as the regulations that apply to an island state. You will have 150 minutes to complete the national part and 90 minutes for the state-specific section of the exam.

For the real estate agent exam, you need to score 70%. To get your license, both the exams must be passed. After passing the real estate saleperson exam, you must submit a licensing form.

For the real estate exam you will need to submit a background search. If you have criminal records, you will also be required to fill out the Request for Preliminary decision Application and provide additional documentation detailing the offenses. The commission will review your information and decide whether you are eligible to obtain your real estate license in hawaii.

Contact the realty commission directly if there are any questions. They will be happy to help you through this process.

Applying for your realty license in hawaii and paying the associated fees is the second stage. You can apply for your license online through your eHawaii account. This streamlines the entire process.

Lastly you will need to have errors and omissions liability insurance when working as a realtor in Hawaii. This protection is important to ensure that both you and your clients are protected in the case of a mistake.

FAQ

Can I afford a downpayment to buy a house?

Yes! There are many programs that can help people who don’t have a lot of money to purchase a property. These programs include conventional mortgages, VA loans, USDA loans and government-backed loans (FHA), VA loan, USDA loans, as well as conventional loans. You can find more information on our website.

What is a reverse mortgage?

A reverse mortgage is a way to borrow money from your home without having to put any equity into the property. You can draw money from your home equity, while you live in the property. There are two types: conventional and government-insured (FHA). With a conventional reverse mortgage, you must repay the amount borrowed plus an origination fee. FHA insurance covers the repayment.

What are the key factors to consider when you invest in real estate?

The first step is to make sure you have enough money to buy real estate. You will need to borrow money from a bank if you don’t have enough cash. You also need to ensure you are not going into debt because you cannot afford to pay back what you owe if you default on the loan.

It is also important to know how much money you can afford each month for an investment property. This amount should include mortgage payments, taxes, insurance and maintenance costs.

Finally, ensure the safety of your area before you buy an investment property. It would be a good idea to live somewhere else while looking for properties.

Statistics

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

External Links

How To

How to be a real-estate broker

You must first take an introductory course to become a licensed real estate agent.

Next, you will need to pass a qualifying exam which tests your knowledge about the subject. This requires you to study for at least two hours per day for a period of three months.

Once you have passed the initial exam, you will be ready for the final. In order to become a real estate agent, your score must be at least 80%.

You are now eligible to work as a real-estate agent if you have passed all of these exams!