If you've ever wondered how to make money on property, you're not alone. Whether you're looking for a second home, investing in a foreclosure, or buying raw land, there are countless ways to earn cash with property. Here are some ideas and strategies to get you started. Whatever you do, don't forget to allow for setbacks or unexpected costs. Listed below are some of the most popular methods:

Rooms to rent in your home

Renting out rooms in your home is an option if it's your own property. You may not have to pay for rent, but it can be an excellent way to earn some extra money. These are some suggestions to help you get started. Prepare the space for renting. You must ensure that the room has electricity and heating. If there is a bath, tell the tenant. Learn how to market the space.

Investing for a second home

A second home investment has many benefits. You can enjoy the comforts of your second residence while still making money. You can use part your savings to buy a new home and the rest to invest in an investment. Even if you never use the second home, you can rent it out for a profit. You can make a profit by renting out a second home.

Foreclosure purchase

When investing in foreclosures, there are some things you should keep in mind. Before you buy, you need to have a plan. There are two common strategies for buying foreclosures: flipping or holding the home for the long term. Both strategies can yield good profits. It is up to you to decide which strategy works best for your situation and finances. To ensure you get the best value for your money, read the following tips.

Investing In Raw Land

Raw land investment offers many benefits to real estate investors. Raw land can be converted into numerous entities, including commercial and residential, unlike commercial and residential property. Whether your investments will be in the form of a single unit, multiple units, or a complex, the potential for profit is huge. You can also earn handsome returns over the long-term because raw land is subject to appreciation.

Investing in multifamily housing

Real estate investing is a great way to grow your net worth over the long term. Multifamily properties can be a good investment because they meet a fundamental need. These properties can provide housing for those who otherwise might not have the financial resources to purchase a home. These properties are also risk-free. However, it's important to analyze the details of the properties and speak to an expert. Many landlords buy multifamily properties in hopes of making extra income every month or reducing home ownership costs.

FAQ

Can I get a second mortgage?

Yes. However, it's best to speak with a professional before you decide whether to apply for one. A second mortgage is often used to consolidate existing loans or to finance home improvement projects.

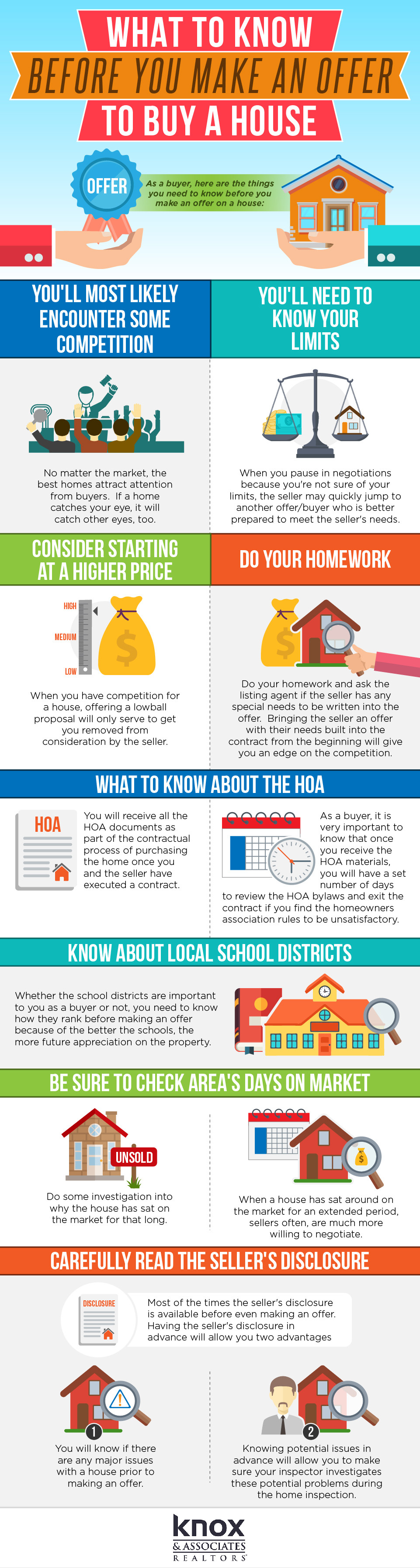

What should I do before I purchase a house in my area?

It depends on how much time you intend to stay there. Start saving now if your goal is to remain there for at least five more years. However, if you're planning on moving within two years, you don’t need to worry.

How long does it take for my house to be sold?

It all depends on several factors such as the condition of your house, the number and availability of comparable homes for sale in your area, the demand for your type of home, local housing market conditions, and so forth. It can take anywhere from 7 to 90 days, depending on the factors.

How many times can my mortgage be refinanced?

It all depends on whether your mortgage broker or another lender is involved in the refinance. Refinances are usually allowed once every five years in both cases.

How long does it usually take to get your mortgage approved?

It all depends on your credit score, income level, and type of loan. Generally speaking, it takes around 30 days to get a mortgage approved.

Do I need flood insurance?

Flood Insurance protects against damage caused by flooding. Flood insurance protects your belongings and helps you to pay your mortgage. Learn more information about flood insurance.

Statistics

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

How do I find an apartment?

When you move to a city, finding an apartment is the first thing that you should do. This takes planning and research. It involves research and planning, as well as researching neighborhoods and reading reviews. You have many options. Some are more difficult than others. Before renting an apartment, it is important to consider the following.

-

You can gather data offline as well as online to research your neighborhood. Websites such as Yelp. Zillow. Trulia.com and Realtor.com are some examples of online resources. Local newspapers, landlords or friends of neighbors are some other offline sources.

-

Find out what other people think about the area. Yelp and TripAdvisor review houses. Amazon and Amazon also have detailed reviews. You might also be able to read local newspaper articles or visit your local library.

-

To get more information on the area, call people who have lived in it. Ask them about their experiences with the area. Ask for their recommendations for places to live.

-

Consider the rent prices in the areas you're interested in. You might consider renting somewhere more affordable if you anticipate spending most of your money on food. If you are looking to spend a lot on entertainment, then consider moving to a more expensive area.

-

Find out more information about the apartment building you want to live in. Is it large? What price is it? Is it pet-friendly What amenities are there? Can you park near it or do you need to have parking? Are there any rules for tenants?