It can be a smart decision to become a tenant, regardless of whether you're seeking an income source or an investment. It's a big responsibility, so you should decide whether it is right for you first before you begin looking at houses.

Become a landlord

You'll have to figure out how to finance your business before you can start it. Lenders will usually lend you the money you need for a property rental, but be sure to get enough to cover expenses and recover the cost of your home when you decide to sell it.

You should choose a property that is in good condition and within your budget. This will enable you to maximize profits and reduce losses. You should consider the market, what you are willing to spend, and your preferences before shopping for a property.

Find tenants

Prior to renting out your property, you must find and screen tenants. This includes a background investigation and asking for reference. Although it may sound tedious, this is a necessary part of being an owner, since you are responsible for their health and well-being.

How to set the rental correctly

You'll need to decide how much you're willing to charge for your rental property, so make sure that you compare your rate to other comparable rentals in the area. You will be able to set an affordable price for your apartment.

Find and screen tenants

You can use flyers, Open Houses, Social Media and word of Mouth to promote your apartment or rental house. The final step is to find the right tenant. They should be responsible, respectful, and pay rent on-time.

Be fair and consistent

You should treat every prospective tenant the same way, unless you have specific requirements for them. You should not discriminate because of your race, ethnicity, nationality, religious beliefs, disability or status as a family.

Tenants will expect prompt responses to their emails and phone calls

It might not seem important, but if you are inefficient at sending emails or answering calls, it can result in lost income. Similarly, you should respond to requests for maintenance or repairs promptly.

Be a reasonable tenant

You may feel tempted to keep bad tenants in your apartment or house, but doing so could put you and your property at risk of legal action. It is important to be aware of the laws that govern evictions and the actions you can take or not in the case your tenant breaks a contract.

Rent easily

Signing up for an online service for rent collection can help you streamline many of those time-consuming tasks required to rent your property. These services are especially helpful if you own multiple properties.

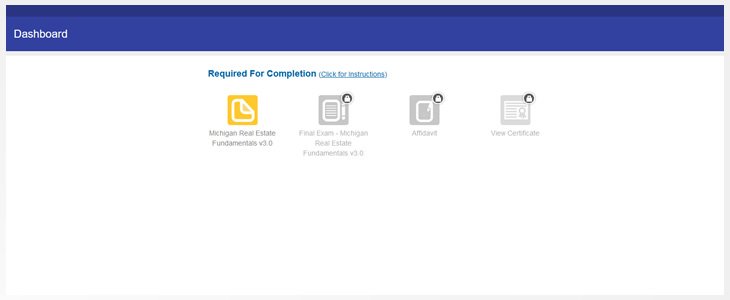

Create an account and log in today to start your rental business, hassle-free!

FAQ

Do I need flood insurance?

Flood Insurance covers flood damage. Flood insurance can protect your belongings as well as your mortgage payments. Learn more about flood insurance here.

How much money can I get to buy my house?

The number of days your home has been on market and its condition can have an impact on how much it sells. The average selling price for a home in the US is $203,000, according to Zillow.com. This

Is it possible for a house to be sold quickly?

You may be able to sell your house quickly if you intend to move out of the current residence in the next few weeks. You should be aware of some things before you make this move. You must first find a buyer to negotiate a contract. The second step is to prepare your house for selling. Third, advertise your property. Finally, you need to accept offers made to you.

What is the average time it takes to get a mortgage approval?

It all depends on your credit score, income level, and type of loan. It takes approximately 30 days to get a mortgage approved.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

External Links

How To

How to Buy a Mobile Home

Mobile homes are houses constructed on wheels and towed behind a vehicle. They have been popular since World War II, when they were used by soldiers who had lost their homes during the war. People who live far from the city can also use mobile homes. There are many options for these houses. Some are small, while others are large enough to hold several families. Even some are small enough to be used for pets!

There are two main types for mobile homes. The first is built in factories by workers who assemble them piece-by-piece. This process takes place before delivery to the customer. You can also build your mobile home by yourself. The first thing you need to do is decide on the size of your mobile home and whether or not it should have plumbing, electricity, or a kitchen stove. Next, make sure you have all the necessary materials to build your home. To build your new home, you will need permits.

If you plan to purchase a mobile home, there are three things you should keep in mind. First, you may want to choose a model that has a higher floor space because you won't always have access to a garage. A larger living space is a good option if you plan to move in to your home immediately. Third, you'll probably want to check the condition of the trailer itself. If any part of the frame is damaged, it could cause problems later.

It is important to know your budget before buying a mobile house. It is important to compare prices across different models and manufacturers. Also, consider the condition the trailers. There are many financing options available from dealerships, but interest rates can vary depending on who you ask.

You can also rent a mobile home instead of purchasing one. Renting allows for you to test drive the model without having to commit. However, renting isn't cheap. Renters generally pay $300 per calendar month.