Oklahoma real estate schools offer an array of courses, including those for licensing and continuing education. Some of the schools offer online classes while others require a face-to-face session. Some are more affordable than others, and some include additional features that other programs don't.

Oklahoma Real Estate Licenses Classes and Licenses

For Oklahoma licensing, you must first complete a pre-licensing 90-hour class at a school that is approved. This course will cover the laws of Oklahoma, contract law and listing agreements. After you complete the course you can apply to get your license.

Real Estate Exams in Oklahoma

To earn your real estate license in Oklahoma, you'll need to pass the state exam. It is a 120-question multiple-choice exam. The test has a national and state-specific section. The exam is broken down into three sections, with a minimum of 75% of questions being answered correctly.

Getting Your Oklahoma Real Estate License

For your Oklahoma real-estate license, you must also complete the background check. This process can last up to six month, but you could complete it faster with some preparation and dedication.

You can take a course at one of Oklahoma's top real estate schools to help you prepare for the exam. These schools will help you to prepare for the test by offering a wide range of resources including practice tests.

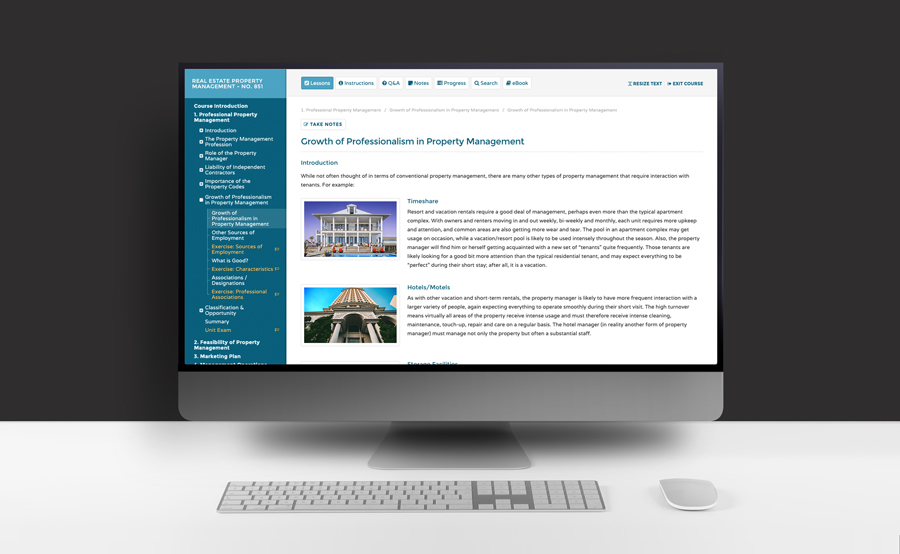

Colibri Real Estate, an Oklahoma-based accredited real estate school, offers several real estate licensing courses and post-licensing classes. Colibri Real Estate has a high pass rate for first time students, and offers several packages tailored to your needs.

The Basics Package costs $377. This includes a ninety-hour prelicensing program, instructor support, as well as three real estate eBooks. It is an excellent choice for those who are looking to save some money on their education.

The Ultimate Learning package is $633, and it includes everything in the above package, plus a physical textbook and a year of membership to their professional development offerings. It's their most comprehensive Oklahoma real-estate school, and can help take your career to a new level.

PDH Real Estate Academy is another reputable Oklahoma real estate school that offers a number of options. Their 90-hour Oklahoma Real Estate Pre-licensing Course teaches the basics of the business, and their Exam prep Package can help prepare you for the state examination.

Real Estate Express offers a great self-paced course. The courses can be discounted up to 25% and come with career resources and digital flashcards.

In addition to the 90-hour pre-licensing education, PDH offers a post-licensing course that can help you renew your license. They also offer a range of CE courses that can be taken online, and they offer exam preparation for both the state and the National Association of Realtors.

FAQ

Should I use an mortgage broker?

A mortgage broker may be able to help you get a lower rate. Brokers can negotiate deals for you with multiple lenders. Some brokers do take a commission from lenders. Before you sign up, be sure to review all fees associated.

How long does it take to sell my home?

It all depends upon many factors. These include the condition of the home, whether there are any similar homes on the market, the general demand for homes in the area, and the conditions of the local housing markets. It may take 7 days to 90 or more depending on these factors.

What amount of money can I get for my house?

It all depends on several factors, including the condition of your home as well as how long it has been listed on the market. The average selling price for a home in the US is $203,000, according to Zillow.com. This

Can I get a second mortgage?

Yes, but it's advisable to consult a professional when deciding whether or not to obtain one. A second mortgage is often used to consolidate existing loans or to finance home improvement projects.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

External Links

How To

How to find houses to rent

Finding houses to rent is one of the most common tasks for people who want to move into new places. It can be difficult to find the right home. When you are looking for a home, many factors will affect your decision-making process. These factors include the location, size, number and amenities of the rooms, as well as price range.

We recommend you begin looking for properties as soon as possible to ensure you get the best deal. Ask your family and friends for recommendations. This way, you'll have plenty of options to choose from.